What Are Tax Exempt Interest Dividends . It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. Know dividend income tax rate, exemption, limit, calculation example and double taxation. tax on dividend income: These dividends come from a mutual fund invested in.

from www.slideserve.com

tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. These dividends come from a mutual fund invested in. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year.

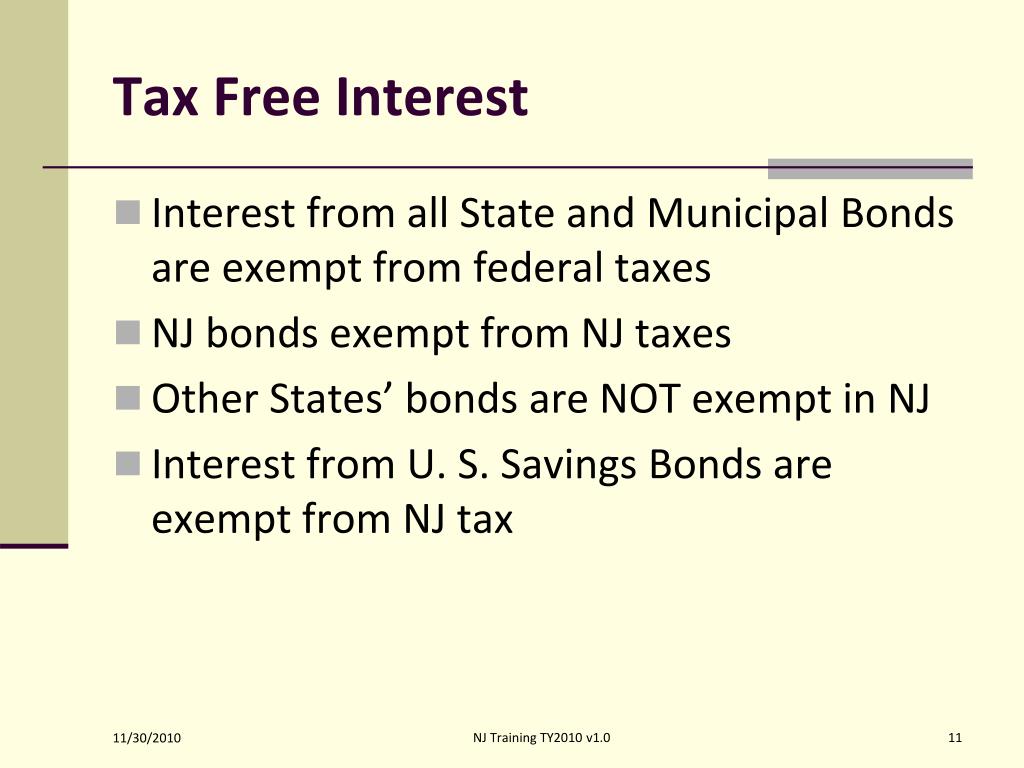

PPT Interest & Dividends PowerPoint Presentation, free download ID

What Are Tax Exempt Interest Dividends It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year.

From ttlc.intuit.com

Do I need to report "federally tax exempt interest dividends" from 1099 What Are Tax Exempt Interest Dividends It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.

From ttlc.intuit.com

How do I determine the EXEMPTINTEREST DIVIDENDS FROM MULTIPLE STATES What Are Tax Exempt Interest Dividends tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. These dividends come from a mutual fund invested in. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. What Are Tax Exempt Interest Dividends.

From corporatefinanceinstitute.com

ExemptInterest Dividend Overview, Value, & Who Should it Seek Out What Are Tax Exempt Interest Dividends These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: What Are Tax Exempt Interest Dividends.

From slideplayer.com

Interest and Dividend ppt download What Are Tax Exempt Interest Dividends These dividends come from a mutual fund invested in. tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. What Are Tax Exempt Interest Dividends.

From help.holistiplan.com

Tax Report Key Figures Tax Exempt Interest, Qualified/Ordinary What Are Tax Exempt Interest Dividends Know dividend income tax rate, exemption, limit, calculation example and double taxation. tax on dividend income: It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.

From slideplayer.com

Interest and Dividend ppt download What Are Tax Exempt Interest Dividends It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. tax on dividend income: What Are Tax Exempt Interest Dividends.

From www.youtube.com

IRS Form 1099DIV Explained Reporting Exempt Interest Dividend What Are Tax Exempt Interest Dividends tax on dividend income: It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. What Are Tax Exempt Interest Dividends.

From www.reddit.com

Question for FreeTaxUSA users State TaxExempt Dividends r/wealthfront What Are Tax Exempt Interest Dividends It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.

From www.slideserve.com

PPT Lesson 3 PowerPoint Presentation, free download ID1761600 What Are Tax Exempt Interest Dividends It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.

From slideplayer.com

Interest and Dividend ppt download What Are Tax Exempt Interest Dividends tax on dividend income: These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. What Are Tax Exempt Interest Dividends.

From ttlc.intuit.com

How do you enter a nominee distribution for exemptinterest dividends? What Are Tax Exempt Interest Dividends tax on dividend income: It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. What Are Tax Exempt Interest Dividends.

From www.slideserve.com

PPT Interest & Dividends PowerPoint Presentation, free download ID What Are Tax Exempt Interest Dividends These dividends come from a mutual fund invested in. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. What Are Tax Exempt Interest Dividends.

From www.slideserve.com

PPT Interest & Dividends PowerPoint Presentation, free download ID What Are Tax Exempt Interest Dividends Know dividend income tax rate, exemption, limit, calculation example and double taxation. These dividends come from a mutual fund invested in. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: What Are Tax Exempt Interest Dividends.

From www.slideserve.com

PPT Interest & Dividends PowerPoint Presentation, free download ID What Are Tax Exempt Interest Dividends It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. Know dividend income tax rate, exemption, limit, calculation example and double taxation. tax on dividend income: What Are Tax Exempt Interest Dividends.

From www.slideserve.com

PPT Interest & Dividends PowerPoint Presentation, free download ID What Are Tax Exempt Interest Dividends Know dividend income tax rate, exemption, limit, calculation example and double taxation. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. tax on dividend income: These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.

From www.slideserve.com

PPT Interest & Dividends PowerPoint Presentation, free download ID What Are Tax Exempt Interest Dividends These dividends come from a mutual fund invested in. tax on dividend income: Know dividend income tax rate, exemption, limit, calculation example and double taxation. It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. What Are Tax Exempt Interest Dividends.

From ttlc.intuit.com

How do I determine the EXEMPTINTEREST DIVIDENDS FROM MULTIPLE STATES What Are Tax Exempt Interest Dividends Know dividend income tax rate, exemption, limit, calculation example and double taxation. tax on dividend income: It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.

From www.slideteam.net

Taxes Exempt Interest Dividends In Powerpoint And Google Slides Cpb What Are Tax Exempt Interest Dividends Know dividend income tax rate, exemption, limit, calculation example and double taxation. tax on dividend income: It is designated as such in a written notice that is mailed to the company’s shareholders within 45 days after the end of the taxable year. These dividends come from a mutual fund invested in. What Are Tax Exempt Interest Dividends.